|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

When Should I Refinance My House: A Comprehensive GuideDeciding when to refinance your house is a crucial financial decision that can lead to substantial savings or additional costs. Understanding the right time to make this move is essential. Understanding RefinancingRefinancing your home involves replacing your existing mortgage with a new one, typically with different terms. This process can help you secure a lower interest rate, reduce monthly payments, or access home equity. Key Indicators for Refinancing1. Lower Interest RatesIf current interest rates are significantly lower than your original mortgage rate, refinancing might be beneficial. A general rule of thumb is a rate drop of at least 1%. 2. Improved Credit ScoreHaving a better credit score than when you first took out your mortgage can qualify you for better rates, making refinancing advantageous. 3. Long-Term SavingsCalculate if the long-term savings outweigh the costs of refinancing, such as closing fees. Utilize online calculators or consult a financial advisor.

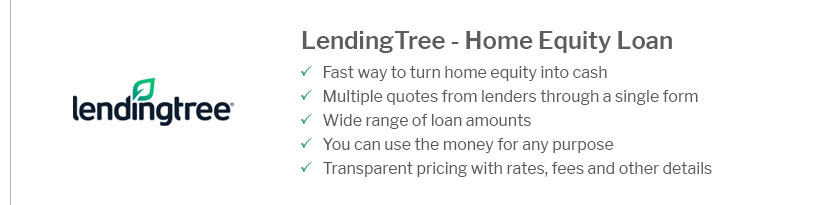

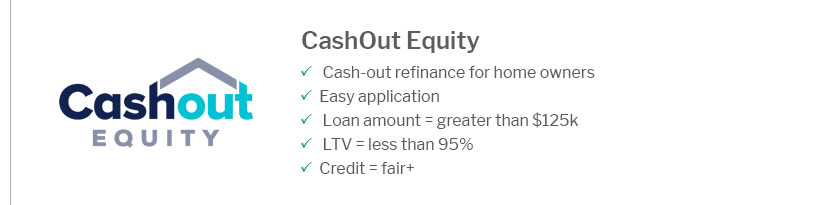

Types of RefinancingDifferent types of refinancing options are available, such as rate-and-term and cash-out refinancing. Each serves different needs and goals. For more detailed information, visit our page on conventional vs fha cash out refinance. Costs and FeesRefinancing involves certain costs, including appraisal fees, application fees, and closing costs. It's important to factor these into your decision-making process. Refinancing AlternativesSometimes, other options might be more suitable than refinancing, such as loan modification or home equity loans. Consider these alternatives carefully. FAQHow does my current interest rate affect my refinancing decision?Your current interest rate plays a critical role in refinancing. If the market offers significantly lower rates, refinancing can reduce your monthly payments and total interest paid over the life of the loan. What is the impact of refinancing on my credit score?Refinancing might temporarily lower your credit score due to the hard inquiry and opening of a new account, but it can recover over time with regular payments. Can I refinance if I have an FHA loan?Yes, you can refinance an FHA loan through various options, including FHA Streamline or converting to a conventional loan. Check the fha cash out refinance rates today for the best options available. https://www.quickenloans.com/learn/reasons-to-refinance-your-home

Refinancing to a lower mortgage rate can decrease your monthly payment, help you save money long term and help you build home equity faster. https://themortgagereports.com/54100/how-soon-can-i-refinance-after-i-close-on-my-mortgage

In most cases, you'll need to wait at least six months after buying a house before you can refinance. Some government-backed loans, such as FHA, ... https://myhome.freddiemac.com/blog/refinancing/when-right-time-refinance

When to Consider Refinancing - Mortgage rates are lower than when you closed on your current mortgage. Locking in a lower interest rate will lower your monthly ...

|

|---|